Top Service News

Overdue Payment Reports Continue to Increase Within the Construction Industry

Published on

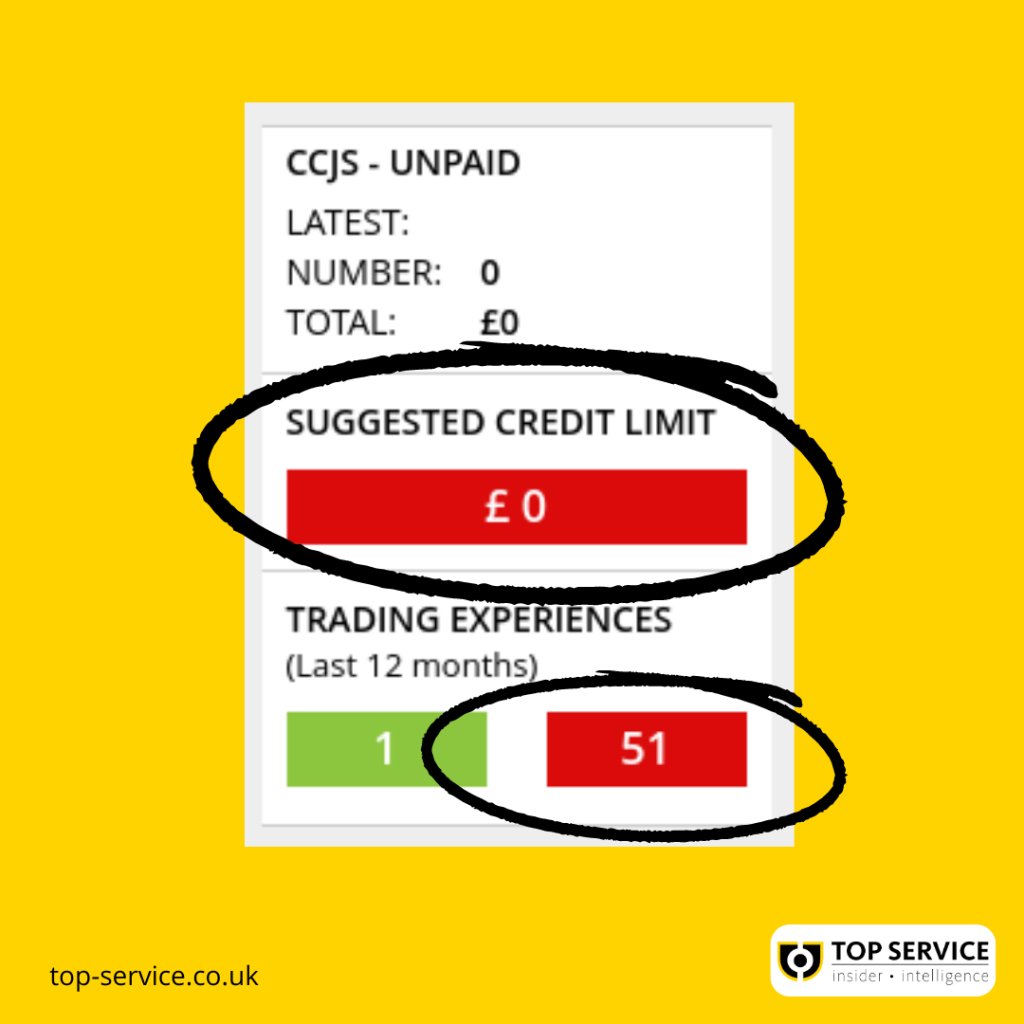

Reports of overdue payments shared exclusively within the Top Service community by Top Service members continue to climb as we make our way through the last quarter of 2023.

Whilst this demonstrates an uncertain time for those operating within the construction industry, sharing trading experiences is the most up to date information available, enabling informed credit decisions to be made.

Also recorded is a substantial 27% increase in the number of adverse trading experiences reported to us in 2023 compared to 2022. An adverse trading experience can include a member reporting that they have needed to take legal action against a company, pass to a third party for collection, advising that their account is overdue or that they have needed to send a third party action letter or email.

Additional Adverse Reports in the Domestic Building Sector

Furthermore, we are able to see an additional increase in the number of reports raised against housebuilders and companies that construct domestic buildings. This may be due to the sharp rise in mortgage rates causing uncertainty in homebuyers and therefore a sudden decrease in the demand for property adding to financial pressures on these companies.

Forecast for 2023

We are able to forecast a 37% increase in adverse payment reports for 2023 overall compared to 2022. This figure emphasises the need for a proactive approach when it comes to credit to assist in mitigating the risks of a bad debt.

Construction activity often declines during the winter months and this seasonal factor can also contribute to the financial challenges faced by companies within the construction industry.

Protecting Your Business from Overdue Payments

Waiting for a Limited Company to file their accounts, which can take up to 1 year and 9 months, may not be practical when trying to assess a company’s creditworthiness especially within an industry such as construction where changes to a company can happen fast, therefore we recommend seeking the services of a reputable credit reference agency if you have not already done so.

Reviewing current credit management practices and tools can assist you in making well informed decisions and therefore reducing the risk of overdue payments.