What is a Credit Policy?

A credit policy provides a framework for managing credit related processes, sets clear expectations and promotes efficient communication within a construction business.

By implementing and adhering to a credit policy, businesses can mitigate financial risks, improve cash flow and support sustainable growth.

A credit policy can support construction businesses in several ways:

Streamlining credit processes:

A credit policy provides clear guidelines and procedures for extending credit to customers. It helps standardise the credit evaluation process, ensuring that consistent criteria is used to assess creditworthiness. This can prevent inconsistencies and biases in credit decisions and improve the efficiency of credit evaluations.

Setting credit limits and payment terms:

A credit policy outlines the factors considered when setting credit limits for customers and determining payment terms. By establishing a systematic approach, the policy helps construction businesses avoid overextending credit to risky customers and ensures that payment terms are appropriate for the industry’s payment patterns. In turn, reducing the risk of late or non-payments and improving cash flow.

Managing invoicing and collections:

A credit policy can provide guidelines for the invoicing process which emphasises the importance of accurate and timely invoicing. It helps invoicing teams understand how their actions affect payment timelines and encourages them to prioritise prompt and accurate invoicing. Additionally, the policy can outline the steps to be taken in case of unpaid invoices, providing a framework for effective credit collection activities.

Enhancing communication and collaboration:

By clearly communicating the credit policy across the organisation, all teams involved in the credit process including business development, invoicing, branch managers, and credit management can understand their roles and responsibilities. This promotes collaboration and a shared understanding of the importance of both sales and cash flow. It reduces friction between teams and fosters a more integrated approach to achieving business goals.

Mitigating risks and improving cash flow:

A well-designed credit policy helps identify potential credit risks and outlines strategies to mitigate them. By minimising the likelihood of non-payment or late payment, construction businesses can improve their cash flow. The policy can also address how to handle invoice disputes promptly, reducing delays in resolving payment issues and ensuring a steady cash flow.

Sharing Your Credit Policy

Sharing a credit policy with customers can contribute to improving and strengthening business relationships.

Transparency and trust:

By sharing your credit policy with customers, you demonstrate transparency and openness in your business practices. This helps build trust and credibility with your customers, as they have a clear understanding of your credit evaluation criteria, payment terms, and dispute resolution processes. It shows that you have well-defined procedures in place and operate in a fair and consistent manner.

Clear expectations: Sharing your credit policy at the beginning of the relationship sets clear expectations for both parties. Customers are aware of what is expected of them in terms of payment timelines, invoice accuracy, and compliance with your credit terms. This can help prevent misunderstandings and disputes in the future.

Improved communication: The credit policy can serve as a communication tool to address any concerns or questions customers may have regarding credit limits, payment terms, or invoice disputes. By proactively sharing this information, you provide an opportunity for dialogue and clarification, fostering better communication and understanding between your business and its customers.

Collaboration and problem-solving: When customers understand the criteria for increasing credit limits, they can actively work towards meeting those requirements. This promotes collaboration and engagement between your business and its customers, as they strive to build a stronger relationship based on mutual trust and financial stability. It creates an environment where both parties work together to find solutions and overcome potential credit-related challenges.

Competitive advantage: In a competitive construction market, having clear and consistent back-office practices can differentiate your business from competitors. By demonstrating a well-defined credit policy and efficient credit management processes, you showcase your professionalism and reliability. This can contribute to winning contracts based not only on price but also on the strength of your business operations and the ease of doing business with you.

Remember to consider the appropriateness of sharing sensitive financial information within your credit policy. While it can be advantageous to communicate your credit policy’s general principles and guidelines, you may need to exercise discretion when sharing specific details related to credit limits, payment terms, or other proprietary information.

Creating a Credit Policy

Creating a credit policy requires careful consideration of the business goals, internal challenges, industry factors, and legal requirements. Here are some steps to help you create an effective credit policy:

Define the business objective: Clearly identify the purpose of the credit policy. Determine why you are extending credit facilities to customers, whether it’s to achieve sustainable growth, remain competitive, or minimize bad debt. This objective will guide the development of your policy.

Involve key stakeholders: Engage relevant departments and individuals impacted by credit facilities and unpaid invoices within the business. Seek input from finance, sales, credit management, and legal teams to understand their challenges and ensure their perspectives are considered in the policy. You may even want to discuss and get ideas from 3rd party providers who support your business’s credit management function. For example, your credit information provider or DCA (Debt Collection Agency)

Consider internal and external factors: Assess your business size, cash flow, and forecasting capabilities. Take into account industry trends and economic or political factors that may impact credit decisions. These considerations will shape the specific guidelines and criteria in your policy.

Review terms and conditions: Evaluate your existing terms and conditions, including payment terms, interest clauses, invoice query resolution, and retention of title clauses. Align these elements with your credit policy to ensure consistency and clarity in customer agreements.

Determine department responsibilities: Clearly define the roles and responsibilities of each department involved in credit-related activities. Identify which teams are responsible for credit evaluations, invoicing, collections, and dispute resolution. This promotes accountability and efficient collaboration.

The balance between risk and customer relationships:

Find the right balance between a restrictive policy that reduces bad debt but may hinder customer acquisition, and a loose policy that increases cash flow risks. Consider your risk tolerance and the impact on customer relationships when setting credit limits and payment terms.

Assess credit tools and resources:

Evaluate the tools and resources needed to achieve the objectives of your credit policy. This may include industry-specific credit information services and collections agencies that align with your business culture and customer relationship goals.

Regular review and evaluation: Once the credit policy is implemented, establish a process for regular review and evaluation. Monitor its effectiveness, identify areas for improvement, and make necessary adjustments to ensure the policy continues to support your business objectives.

Remember, a credit policy is not a one-time creation. It should evolve with your business and adapt to changing circumstances. Regularly assess its effectiveness, update procedures as needed, and stay informed about industry best practices to maintain a strong credit management framework.

Emma Reilly MCICM, CEO and credit expert at Top Service Ltd & her team are always more than happy to discuss credit management practices and tools.

T: 01527 518800

Emma Reilly, CEO at Top Service Ltd guest blog for Registry Trust

Our very own CEO provided a guest blog for the latest Registry Trust newsletter. Discussing the impacts of rising energy costs, interest rates & the impact on the construction industry:

The construction industry is grappling with rising interest rates, which affects the cost of borrowing for construction projects. Additionally, inflation’s impact on the cost of materials and labour further strains construction businesses’ budgets and planning. It’s evident that businesses are facing numerous challenges in 2023:

Energy Costs: The substantial increase in energy costs by an average of 424% since 2021, as reported by the Federation of Small Businesses, puts additional financial pressure on businesses. This increase can impact overall operational costs and potentially affect profitability.

Company Insolvencies: The reported 27% rise in company insolvencies compared to the previous year, as stated by the Insolvency Service, suggests that businesses are facing financial difficulties. Economic instability and various cost-related challenges could be contributing factors.

Business Rates: The increase in business rates from April 1, 2023, based on updated rateable values from the Valuation Office Agency, adds to the financial burdens faced by businesses. Higher business rates directly impact the cost of occupying commercial properties.

Businesses are facing tough decisions to adapt to these financial pressures, such as re-evaluating their cost structures, finding ways to optimise energy consumption, exploring alternative financing options, or adjusting pricing strategies.

The combination of rising energy costs, increased business rates, expensive materials, and other financial pressures is driving more businesses into challenging situations.

The record levels of credit information searches by suppliers, as reported by Top Service, reflect a heightened awareness of the risks associated with extending credit facilities. This signifies that businesses are taking proactive steps to manage their risks and make informed decisions when dealing with other companies.

Reducing risk and maintaining sales while dealing with increased costs requires a delicate balance. Acting promptly when invoices become overdue to improve cashflow is highlighted as a crucial strategy for businesses to weather the challenges posed by rising costs and financial uncertainties. The construction industry, like all industries across the UK, needs to be proactive, agile, and simultaneously focused on the small details and big picture in order to successfully navigate the current economic environment.

Rachel Maclean MP Visits Top Service in Redditch

We were pleased to welcome Rachel Maclean MP to our offices in Redditch to discuss Top Service’s success & growth.

Rachel says “

Meet Emma Reilly MCICM and Lisa Cardus from Top Service Ltd – two formidable business women who have taken their company from strength-to-strength!

Over the past year they have increased headcount by 25%, and their growth plans mean they will be hiring even more staff this year and next.

Their enthusiasm for what they do shone through on my visit today. It’s always uplifting to visit such a successful #Redditch business.”

Latest Insolvency Statistics – July 2023. HMRC Petitions result in a sharp rise in compulsory liquidations.

The latest insolvency statistics have been published today by The Insolvency Service.

The number of registered company insolvencies in July 2023 was 1,727, 6% lower than in the same month in the previous year (1,831 in July 2022). This was higher than levels seen while the Government support measures were in place in response to the coronavirus (COVID-19) pandemic and also higher than pre-pandemic numbers.

There were 248 compulsory liquidations in July 2023, 81% higher than in July 2022. Numbers of compulsory liquidations have increased from historical lows seen during the coronavirus pandemic, partly as a result of an increase in winding-up petitions presented by HMRC.

In July 2023 there were 1,336 Creditors’ Voluntary Liquidations (CVLs), 17% lower than in July 2022. Numbers of administrations and Company Voluntary Arrangements (CVAs) were higher than in July 2022.

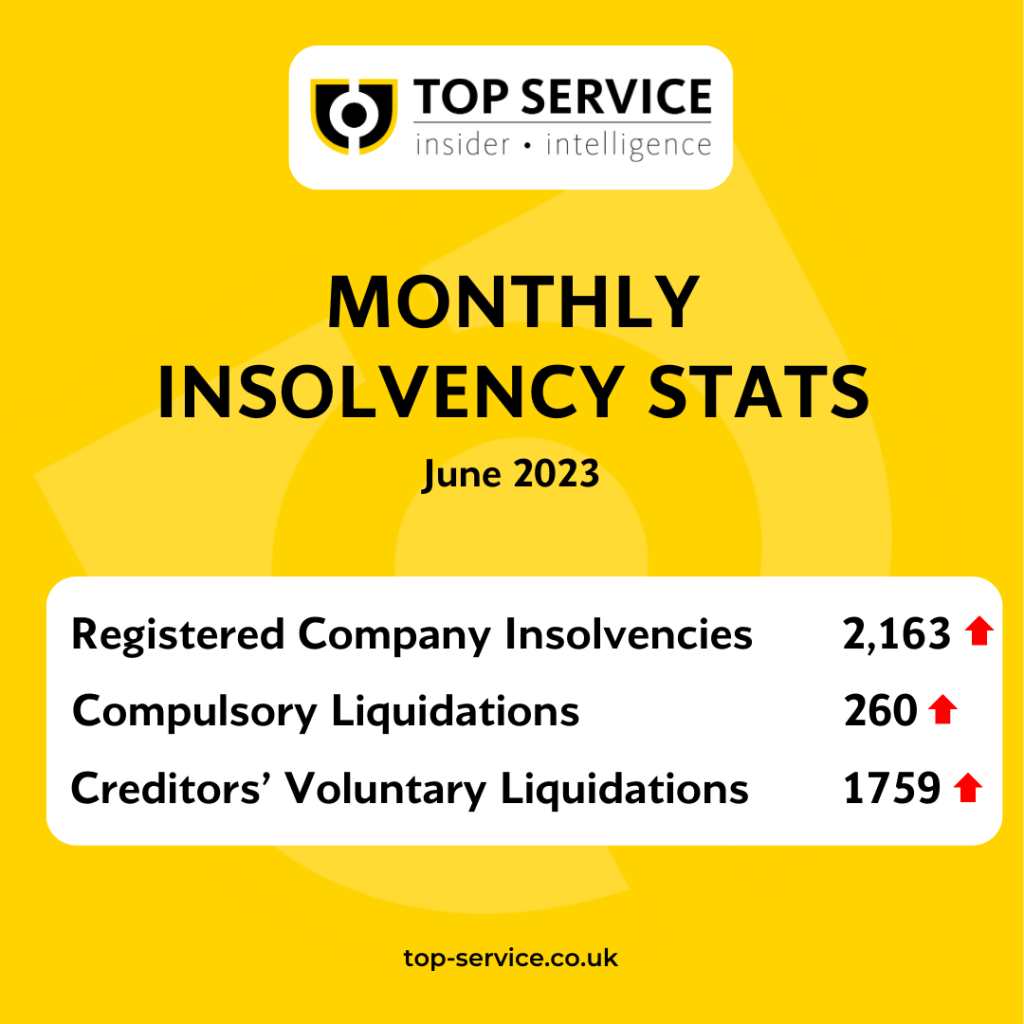

Latest Insolvency Statistics – June 2023

The latest insolvency statistics have been released by the Insolvency Service and show an increase overall in corporate insolvencies

The number of registered company insolvencies in June 2023 was 2,163, 27% higher than in the same month in the previous year (1,698 in June 2022). This was higher than levels seen while the Government support measures were in place in response to the coronavirus (COVID-19) pandemic and also higher than pre-pandemic numbers.

There were 260 compulsory liquidations in June 2023, 77% higher than in June 2022. Numbers of compulsory liquidations have increased from historical lows seen during the coronavirus pandemic, partly as a result of an increase in winding-up petitions presented by HMRC.

In June 2023 there were 1,759 Creditors’ Voluntary Liquidations (CVLs), 21% higher than in June 2022. Numbers of administrations and Company Voluntary Arrangements (CVAs) were also higher than in June 2022.

Emma Reilly advises ‘Now is the time to look at your current credit management tools and processes and review if they are adequate to maximise protection for a business. Understanding how your customers & potential customers are paying other suppliers should be a vital part of your due diligence. Ensuring you have an effective debt collection partner is also key, working with a business who shares your values and can collect money owed to you, whilst protecting your reputation will help to increase you cashflow.;

Retention Of Title & Insolvency

Supplying goods on credit can be a risky business. In the midst of tough economic times, it is more important than ever for businesses to protect themselves against the risk of a customer becoming insolvent.

One way to do this could be the effective introduction of a retention of title clause. We’re delighted to bring you this information in conjunction with PKF. Thank you to the author and Top Service friend, Brendan Clarkson.

So What Is Retention of Title (‘ROT’)?

A valid ROT clause allows a supplier to retain ownership over goods supplied until such time as certain conditions are met, often the payment to the supplier of all sums owed.

The clause displaces the usual position that ownership/title of goods passes to the buyer on delivery.

A ROT clause is sometimes known as a ‘Romalpa’ or reservation of title clause.

Why should I have a ROT clause?

Provided it has been carefully worded, the clause affords the supplier a further layer of protection against the buyer’s default. This means that on an insolvency, the supplier is potentially entitled to:

- retain legal title over the goods until all sums owed are paid;

- claim the proceeds of any resale of the goods; or

- claim rights over any new products manufactured from the goods supplied.

This is likely to be of greater value to the supplier than claiming for an unsecured dividend in the formal insolvency process.

How can I make sure my ROT clause works ?

It is essential that your clause is written correctly and that your systems operate in such a way as to maximise the prospects of recovering your stock. It would always be our advice to seek advice from a lawyer with regards to drafting a retention of title clause and to have the clause reviewed regularly.

There is no guarantee that an ROT clause will work, as it depends not only on the wording of the clause but how the clause operates in practice. There are three main areas that lawyers will usually investigate:

Incorporation

An ROT clause which is not effectively incorporated into the contract between the seller and insolvent buyer will ultimately fail. Incorporation is a legal term which, in this context, means that the seller’s terms and conditions of trade have been accepted by the buyer.

A simple ROT clause imposed after the contract is made – for example, terms stated on the back of a sales invoice – is likely to be rejected by a liquidator or administrator on the basis that it is a post-contractual document.

Suppliers should ensure that a contractual document – such as a carefully worded credit application form containing the conditions of trade and the ROT clause(s) – is signed by both parties before any goods are delivered.

Identification of the goods

ROT clauses are only effective if the supplier can identify which goods belong to him. This can be especially difficult where identical goods have been supplied by different sellers.

It is sensible to ensure that your product is marked in a way that is easily identifiable. High value items such as plant and machinery should always be labelled with proper specification and serial numbers and manufacturers’ name plates. Lower value items should at least have a batch number or date stamped on their packaging and this should be referenced in your invoice.

Retaining identity

If your supplies have been used in a manufacturing process which alters the goods so that they do not retain their original identity, it is unlikely that you will be able to claim ROT.

In a well-known court case, a seller’s ROT claim was defeated as the resin supplied had been incorporated by the manufacturer into chipboard, thereby losing its identity. There is much case law in this area with each claim turning on its own facts and on the terms of the particular contract.

What happens to goods & equipment held under a ROT clause?

The moratorium created by an administration means that a supplier cannot take back their stock without the permission of the court or the administrator. However, if an administrator deliberately deals with property in a manner inconsistent with another person’s rights and deprives them of possession and use, they could be liable for damages under the tort of conversion (a person without authority, does any act, which interferes with the title of goods owned by another person).

Most ROT clauses give the buyer the ability to use the stock in the ” normal course of business”. So if the administrator continues to trade the business, it is likely that normal sales of the goods will be permitted by this part of the clause.

In practice, the administrator will usually invite the supplier to attend the site and identify their goods. Any stock used by the administrator after their appointment will then be paid for (usually at retail price which clearly benefits the supplier and avoids the need for collection and re-sale).

Quick Tips?

- Ensure that your ROT clause is effectively incorporated into the contract with your customer .

- Review your procedures in respect of new customers – terms and conditions of sale should be signed by both parties before the first delivery is made.

- If your clause is some years old, it is worth reviewing the terms and conditions to ensure they are tailored to the issues that may arise in the specific market in which you operate.

- Seek advice from your solicitor if you are in any doubt.

- Ensure that your products can be easily identified – where appropriate, use serial numbers and name plates/labels.

- As soon as you are aware of a customer entering any form of insolvency, contact the office holder as soon as possible. Provide details of your ROT claim and arrange to attend the customer’s premises to identify your goods. Once on site, label your goods with stickers and agree your inventory with the insolvency practitioner’s representative.

For more information please do not hesitate to contact our team on 01527 518800

J Tomlinson Ltd Files Notice of Intent to Appoint Administrators

Nottingham based J Tomlinson Ltd file a Notice of Intent to Appoint Administrators yesterday afternoon (10/07/2023). Reports suggest that over 400 jobs will be lost.

A Notice of intent to Appoint Administrators is a court filed document giving notice of the companies intention to go into Administration. Once filed a moratorium is created over the company for a period of 10 days. This protects the company from legal action starting or continuing by creditors (without permission from the court).

In most cases an Administrator is appointed after 10 days, unless a solution to the financial issues faced by the company is found. In some cases the 10 day period is extended, if the court is satisfied an extension would be of benefit to the creditors.

Our members are being kept up to date with the situation.

Protect Your Business From The Risks Associated With Bad Debt.

The current increase in insolvency figures, coupled with rising material costs & labour shortages, highlights the importance of taking preventative measures when taking on new customers as well as keeping cash flowing through the business with the effective collection of overdue invoices.

By implementing effective credit management practices, you can protect your business from the risks associated with bad debt.

Standard credit information can help you assess the level of risk when dealing with new customers and maintaining ongoing trading relationships. Obtaining an unbiased third-party opinion, which analyses financial data, public records, economic indicators, and industry pressures, can provide valuable insights into a company’s creditworthiness.

However, industry-specific credit information goes beyond a standard credit report. By leveraging a community of businesses sharing their trading experiences, you can develop a more accurate assessment of the risk to your business.

Understanding the potential delays in receiving payments beyond the agreed terms is essential in determining whether your business can manage the associated risks. By considering the average time it takes to obtain payment under normal circumstances and the credit amount involved, you can assess if your business can sustain such delays.

Even if a standard credit report indicates a favourable financial position, relying solely on this may lead to overlooking vital information specific to your industry. For instance, other suppliers may currently face significant payment issues, which could adversely impact your business if not taken into account.

Hence, it is crucial to have access to industry-specific credit information to gain a comprehensive understanding of the creditworthiness of your customers. This way, you can mitigate the potential risks associated with delayed payments and ensure the financial stability of your business.

Assessing Risk Doesn’t Stop at The Account Opening Process

Regularly assessing the credit risk of a new customer is crucial in order to minimise the risk of bad debt and protect your business.

While the account opening process provides initial information about the customer’s creditworthiness, it is important to continuously monitor for any changes that may impact their ability to make timely payments.

Receiving notifications about county court judgments (CCJs) and other court orders can provide valuable insights into a customer’s financial situation. However, it may already be too late to take appropriate action. Other creditors may have already taken steps to recover their debts, leaving your overdue invoice further down the line.

In addition to relying on mainstream credit information, it is beneficial to receive early warnings about changes in trading patterns and experiences from other suppliers. These insights can provide crucial information about the financial health of your customer and their ability to meet their payment obligations.

By implementing these strategies and staying informed about your customers’ creditworthiness and payment habits, you will effectively manage credit risk throughout the customer journey and protect your business from potential financial losses.

For construction businesses we offer a free trial of our industry specific credit information and debt recovery services.

Contact our team of experts on 01527 518800 for more information.

Crisis Situation at Henry Construction Projects Ltd

As the construction sector’s only specialist credit reference agency we have been monitoring the situation closely and have been providing our members with up-to-the-minute updates.

We have been tracking sporadic periods of slow payments by Henry Construction Projects Ltd for the past decade but the frequency of slow payments has increased over the past twelve months.

Due to insider information gleaned from our 3,000 members we reduced the company’s recommended credit limit to zero in September 2022. We currently have almost 200 reports of late or non payment from our construction industry members.

Numerous early warnings have been sent to our members, warning them of the increased risk.

We have successfully collected just over £600k on behalf of our members during the first half of 2023.

The company was set up 13 years ago by William Henry as a small civils and groundworks company. Since then it has grown into a multi-disciplined construction contractor turning over more than £400m per annum primarily concentrating on residential and mixed use projects in the South East. The company is currently owned by 45 year old Mark James Henry.

The company was in the news last month as it was fined £234k by Westminster Magistrates Court for a preventable ‘fall from height’ incident two years ago which injured a Romanian national. It’s not known whether this fine has been paid.

Emma Reilly MCICM MCIM CEO of Top Service, commented:

“We are monitoring this situation very closely and keeping our members informed. At this stage of play it is very unlikely that the company will be able to avoid insolvency proceedings”.