Company Insolvency numbers in June 2024 were higher than in May 2024.

The Insolvency Service has published the latest figures for June 2024, offering a detailed overview of the insolvency landscape in the UK.

Here’s a breakdown of the numbers:

Registered Company Insolvencies Breakdown:

- In June 2024, a total of 2361 company insolvencies were recorded, with the following distribution:

- 📈 1866 Creditors’ Voluntary Liquidations

- 🚫 302 Compulsory Liquidations

- 🏢 170 Administrations

- 📄 23 Company Voluntary Arrangements

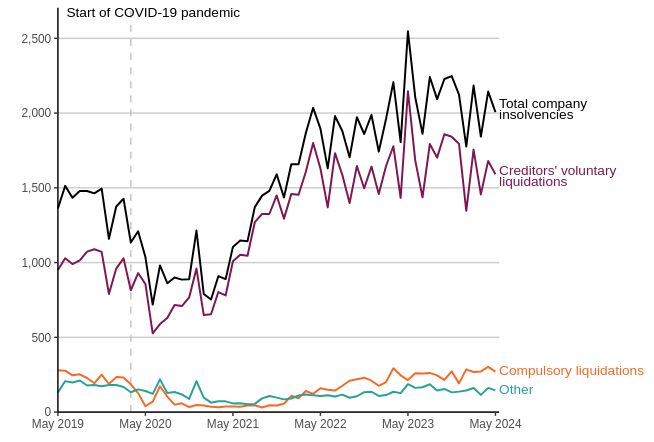

📊 Creditors’ Voluntary Liquidations comprised 79% of the total company insolvencies, continuing their significant yearly increase since 2021.

Yearly Comparison of Insolvency Types:

📈 Comparing June 2024 with the same month in the previous year reveals a notable increase. There’s been a 17% increase in insolvency cases, with June 2024 witnessing 345 more cases than June 2023.

Changes in Insolvency Types Year on Year:

- 🚫 Compulsory Liquidations: Increased by 19%

- 📈Creditors’ Voluntary Liquidations: Increased by 16%

- 🏢 Administrations: Increased by 22%

- 📄 Company Voluntary Arrangements: Increased by 64%

Month-on-Month Comparison:

Company insolvency numbers in June 2024 were higher than in May 2024.

📅 In June 2024, there was an 16% increase in insolvency cases compared to May 2024, marking a significant increase of 321 cases.

Month-on-Month Changes in Insolvency Types (May to June Comparison):

- 🚫 Compulsory Liquidations: Increased by 10%

- 📈 Creditors’ Voluntary Liquidations: Increased by 16%

- 🏢 Administrations: Increased by 30%

- 📄 Company Voluntary Arrangements: Increased by 21%

🔍 We encourage all credit management teams across the industry to stay vigilant and seek out the most valuable tools and information available. To learn more about how we can help you minimise risk and maximise cash flow, call in to speak with one of our experts today on 📞 01527 518800.

What is a Notice of Intention and What Does it Mean for Creditors?

What is a Notice of Intention?

A Notice of Intention (NOI) is filed either by a company, its directors or a floating charge holder (usually a bank) outlining that they wish to enter the company into Administration if an immediate solution to the company’s financial problems cannot be found. The notice which is filed at court contains details of the intended insolvency practitioners should the company enter into administration.

How does this affect the company’s creditors?

Once the notice has been filed, a protective dome (Moratorium) is placed over the company. This safeguards the company from any creditors wishing to take legal action, including issuing a Winding-up Petition, against the company in order to recover their overdue balance without express permission from the court. This can be a powerful tool for a company in financial distress as it provides a breathing space to allow them time to resolve the company’s financial situation, for example selling part of or all of the company to raise funds or to find a licensed insolvency practitioner to handle the Administration proceedings.

How long does the Notice of Intention last?

This moratorium lasts for 10 business days. It is possible for the company to apply for an extension and gain an additional 10 business days, as long as the court deems the extension in favour of the creditors and that the moratorium is not being abused for the companies benefit, for example, avoiding legal action taken by creditors.

Once the Notice of Intention expires and provided that no additional notice of intention or appointment has been filed, a creditor can continue to take legal action. It is worth noting however, that the company may not have the funds to pay the full balance owed and this should be taken into consideration.

When can’t a notice of intention be filed?

A Notice of Intention cannot be filed if the company has entered into Administration within the last 12 months or a Winding-up Petition has already been filed against the company.

Are there any disadvantages for the company?

The Notice of Intention is a very public event and can damage the company’s reputation and its ability to continue trading with suppliers and clients who are aware of the notice and therefore the company’s financial difficulties.

How Can Top Service help?

Our team of credit management experts has its ears to the ground and collectively possesses hundreds of years of knowledge and experience. It is our industry expertise that enables our team to swiftly respond to changes in trading patterns and address rumours and concerns within the construction sector, minimising your risk of bad debt. To learn more about our prevention services, give Top Service a call at 01527 518800.

Top Service Appoints Philip King FCICM as Non-Exec Director

We are thrilled to announce the appointment of Philip King FCICM as a Non-Executive Director at Top Service, effective July 1st.

Philip brings a wealth of experience in the credit management industry. After starting his career in the construction sector, Philip spent 14 years as Chief Executive of the Chartered Institute of Credit Management, and 18 months as the interim UK Small Business Commissioner. His expertise will be invaluable as we focus on building our brand, raising our profile, and growing our established business to become the preferred supplier of credit information and debt recovery services for the UK construction industry.

Emma Reilly CEO, shared, “It’s an absolute pleasure to welcome Philip to Top Service. After meeting him through his work with the CICM and engaging in numerous conversations, it became clear that we share a passion for credit management and supporting the industry in recognising its vital role in every business.”

Emma continued “With Philip’s appointment, we are poised to achieve our vision and further strengthen our position in the market, delivering exceptional value to our members and the wider UK construction & credit management industry”.

Philip King on his appointment “I’m delighted to be joining Top Service to work with their excellent team who deliver services of the highest quality to credit professionals in the challenging construction sector. I’ve been advocating the importance of good credit management throughout my career, and this is as true today as it has ever been. I’m looking forward to using my experience, and the lessons I’ve learned over many years, to help them enhance the profile they’ve established over the past 30 years.”

Exciting news!

We’re thrilled to unveil our new logo, marking a significant milestone in our journey. This refresh represents our commitment to innovation and growth in the UK construction and credit management sector.

Behind the scenes, we’ve been diligently preparing to realise our vision and solidify our market position. Our focus remains on delivering unparalleled value to our members and the industry at large.

This new visual identity illustrates our dedication to progress and excellence & ensures it is clear what we achieve for our members. Supporting construction businesses to minimise debt & maximise cash.

Stay tuned for more updates as we continue our business journey and strive to be the go to credit information and debt recovery service provider for the UK construction industry.

📊 Insolvency Statistics Update – May 2024

The Insolvency Service has released the latest figures for May 2024, providing a comprehensive overview of the insolvency landscape in the UK.

Company insolvency dropped 6% compared to April 2024 but insolvency remains higher than those seen during Covid-19 and between 2014 – 2019.

📈 Overview of Registered Company Insolvencies

In May 2024, a total of 2,006 company insolvencies were recorded. The breakdown is as follows:

- 📉 1,590 Creditors’ Voluntary Liquidations (CVLs)

- 🚫 271 Compulsory Liquidations

- 🏢 126 Administrations

- 📄 19 Company Voluntary Arrangements (CVAs)

📅 Yearly Comparison: May 2024 vs. May 2023

When comparing May 2024 to the same month in the previous year, a significant trend emerges. There has been a 21% decrease in the total number of insolvencies, with May 2024 witnessing 541 fewer cases than May 2023.

📊 Changes in Insolvency Types Year-on-Year:

- 🚫 Compulsory Liquidations: Increased by 27%

- 📉 Creditors’ Voluntary Liquidations: Decreased by 26%

- 🏢 Administrations: Decreased by 20%

- 📄 Company Voluntary Arrangements: Decreased by 37%

This yearly comparison indicates a mixed trend in insolvency types. While compulsory liquidations have surged, other types of insolvencies have notably decreased.

📆 Month-on-Month Comparison: April 2024 vs. May 2024

Examining the month-on-month data reveals a slight decrease in insolvency cases from April to May 2024. Specifically, there was a 6% decrease, equating to 138 fewer cases in May compared to April.

📉 Month-on-Month Changes in Insolvency Types:

- 🚫 Compulsory Liquidations: Decreased by 10%

- 📉 Creditors’ Voluntary Liquidations: Decreased by 5%

- 🏢 Administrations: Decreased by 13%

- 📄 Company Voluntary Arrangements: Increased by 6%

UK construction insolvencies remain at elevated levels but there are signs the numbers are beginning to level out, demonstrating the industry’s resilience & adaptability

The fact remains that credit management teams across the industry must remain vigilant and continue to look for the most valuable tools and information available to them. To understand more about how we can help you minimise risk and maximise cash flow, call in to speak with one of our experts today on 01527 518800.

Insolvency Statistics Update – April 2024

The Insolvency Service has released the latest figures for April 2024, shedding light on the insolvencies in the UK. Here’s a breakdown of the numbers:

Registered Company Insolvencies Breakdown:

- In April 2024, a total of 2,177 company insolvencies were recorded, with the following distribution:

- 📉 1,715 Creditors’ Voluntary Liquidations

- 🚫 300 Compulsory Liquidations

- 🏢 144 Administrations

- 📄 18 Company Voluntary Arrangements

📊 Creditors’ Voluntary Liquidations accounted for 79% of all company insolvencies in April 2024. The number of CVLs increased by 18% from March 2024 and was 17% higher than in April 2023.

Yearly Comparison of Insolvency Types:

📈 Comparing April 2024 with the same month in the previous year reveals a notable increase. There’s been an 18% increase in insolvency cases, with April 2024 witnessing 339 more cases than April 2023.

Changes in Insolvency Types Year on Year:

- 🚫 Compulsory Liquidations: Increased by 21%

- 📈Creditors’ Voluntary Liquidations: Increased by 17%

- 🏢 Administrations: Increased by 25%

- 📄 Company Voluntary Arrangements: Increased by 50%

Month-on-Month Comparison:

📅 In April 2024, there was an 18% increase in insolvency cases compared to March 2024, marking a significant increase of 339 cases.

Month-on-Month Changes in Insolvency Types (March to April Comparison):

- 🚫 Compulsory Liquidations: Increased by 11%

- 📈 Creditors’ Voluntary Liquidations: Increased by 18%

- 🏢 Administrations: Increased by 36%

- 📄 Company Voluntary Arrangements: Increased by 100%

In April 2024, there were 2,177 recorded company insolvencies, 300 of which were in the construction industry. The breakdown within the construction sector includes:

- 🏗️ 122 cases in the construction of buildings

- 🏞️ 14 in civil engineering

- 🛠️ 184 in specialised construction activities

🔍 With the recent increase in the number of insolvencies, it is crucial to monitor and respond to changes within your customer database. In today’s dynamic business environment, staying proactive in identifying and addressing potential risks is essential for sustaining long-term success. To understand more about how we can help you minimise risk and maximise cash flow, call in to speak with one of our experts today on 📞 01527 518800.

Retention of Title – Practical advice to enable recovery of unpaid goods

Understanding Retention of Title

Supplying goods on credit can be a risky business. In the midst of tough economic times, it is more important than ever for businesses to protect themselves against the risk of a customer becoming insolvent.

What is Retention of Title (ROT)?

A valid ROT clause allows a supplier to retain ownership over goods supplied until such time as certain conditions are met, often the payment to the supplier of all sums owed. The clause displaces the usual position that ownership/title of goods passes to the buyer on delivery.

A ROT clause is sometimes known as a ‘Romalpa’ or reservation of title clause.

Why should I have a ROT clause?

Provided it has been carefully worded, the clause affords the supplier a further layer of protection against the buyer’s default. This means that on an insolvency, the supplier is potentially entitled to:

• Retain legal title over the goods until all sums owed are paid;

• claim the proceeds of any resale of the goods; or

• claim rights over any new products manufactured from the goods supplied.

This is likely to be of greater value to the supplier than claiming for an unsecured dividend in the formal insolvency process.

How can I make sure my ROT clause works?

It is essential that your clause is written correctly and that your systems operate in such a way as to maximise the prospects of recovering your stock. There is no guarantee that an ROT clause will work, as it depends not only on the wording of the clause but how the clause operates in practice. There are three main areas that lawyers will usually investigate:

Incorporation

An ROT clause which is not effectively incorporated into the contract between the seller and insolvent buyer will ultimately fail. Incorporation is a legal term which, in this context, means that the seller’s terms and conditions of trade have been accepted by the buyer. A simple ROT clause imposed after the contract is made, for example terms stated on the back of a sales invoice, is likely to be rejected by a liquidator or administrator on the basis that it is a post-contractual document. Suppliers should ensure that a contractual document, such as a carefully worded credit application form containing the conditions of trade and the ROT clause(s) is signed by both parties before any goods are delivered.

Identification of the goods

ROT clauses are only effective if the supplier can identify which goods belong to him. This can be especially difficult where identical goods have been supplied by different sellers. It is sensible to ensure that your product is marked in a way that is easily identifiable. High value items such as plant and machinery should always be labelled with proper specification and serial numbers and manufacturers’ name plates. Lower value items should at least have a batch number or date stamped on their packaging and this should be referenced in your invoice.

Retaining identity

If your supplies have been used in a manufacturing process which alters the goods so that they do not retain their original identity, it is unlikely that you will be able to claim ROT. In a well-known court case, a seller’s ROT claim was defeated as the resin supplied had been incorporated by the manufacturer into chipboard, thereby losing its identity. There is much case law in this area with each claim turning on its own facts and on the terms of the particular contract.

Can an administrator do whatever he wants with the ROT stock?

The simple answer is “no”. The moratorium created by an administration means that a supplier cannot take back his stock without the permission of the court or the administrator. However, if an administrator deliberately deals with property in a manner inconsistent with another person’s rights and deprives them of possession and use, he could be liable for damages under the tort of conversion. In practice, the administrator will usually invite the supplier to attend the site and identify their goods. Any stock used by the administrator after their appointment will then be paid for (usually at retail price which clearly benefits the supplier and avoids the need for collection and re-sale).

Other insolvency procedures

Assuming the ROT clause is valid, a supplier’s claim to any unused goods will be binding against any liquidator, administrator or trustee in bankruptcy, i.e. the office holder cannot dispose of the goods for the general benefit of the liquidation/ administration/bankruptcy estate.

Are there any quick tips for ROT clauses?

Ensure that your ROT clause is effectively incorporated into the contract with your customer.

1. Review your procedures in respect of new customers – terms and conditions of sale should be signed by both parties before the first delivery is made.

2. If your clause is some years old, it is worth reviewing the terms and conditions to ensure they are tailored to the issues that may arise in the specific market in which you operate.

3. Seek advice from your solicitor if you are in any doubt.

4. Ensure that your products can be easily identified – where appropriate, use serial numbers and nameplates/labels.

5. As soon as you are aware of a customer entering any form of insolvency, contact the office holder as soon as possible. Provide details of your ROT claim and arrange to attend the customer’s premises to identify your goods. Once on site, label your goods with stickers and agree your inventory with the insolvency practitioner’s representative.

Thank you to our friends at PKF Littlejohn Advisory for producing the facts around Retention of Title for our use.

Emma Reilly, CEO – Message to Top Service Members

A message to Top Service members from Emma Reilly FCICM, CEO at Top Service Ltd & Credit Expert: How can insolvency happen without any warning signs?

Changes to the Small Claims Track

From 22nd May, 2024, any money claims up to £10,000 must undergo a free one-hour mediation session through HMCTS’ Small Claims Mediation Service. This means small claims mediation is now mandatory.

This new requirement aims to reduce the number of claims reaching court, freeing up to 5,000 judicial sitting days annually to focus on more complex cases.

Key Benefits of This Change:

- Mediation sessions are usually organised within 28 days, much quicker than waiting for a court date.

- There’s no hearing fee for mediation, making it a cheaper alternative to court proceedings.

- Mediation provides a calm, non-judgemental environment for parties to resolve disputes, avoiding the stress of a court battle.

- HMCTS has more than doubled its mediators from 25 to 64, ensuring ample support for this initiative.

The change will also apply to small claims issued via OCMC (Online Civil Money Claims) but at a later date.

You can read more about this change here https://www.gov.uk/government/news/faster-resolution-for-small-claims-as-mediation-baked-into-courts-process

If you currently have any debts owed to you, Top Service offers a No Win, No fee debt recovery service, exclusively for businesses within the construction sector. Please get in touch on 01527 503990 to speak with one of our advisers to find out more about how we can support you!

Winding-Up Petitions & The Consequences They Can Have On A Business.

A Winding-Up Petition can have a detrimental Impact on a company and with the number of Compulsory Liquidations rising it’s important to understand the processes, risks and consequences of Winding-Up Petitions, we explain these below.

What is a Winding-Up Petition?

A Winding-Up Petition is a document filed at the courts usually by a trade creditor, financial institution or HMRC advising of the intention to force a company into compulsory liquidation, as a result of the company’s inability to pay its debts as and when they fall due and consequently the company is believed to be trading insolvent.

When can a Winding-Up Petition be filed?

A Winding-Up Petition can only be filed for an overdue balance over £750.00 and only if the company does not already have an existing Winding-Up Petition or Moratorium in place protecting them from legal action. If the balance owed has a dispute on the account then the creditor can issue a winding up petition on the undisputed balance, if that balance is over £750.

Issuing a Winding-Up Petition

Issuing a Winding-Up Petition not only comes at a cost but can dramatically impact the debtor company once filed, it is important to first gain an understanding of whether the debtor company won’t pay or can’t pay. The Winding-Up Petition process can be complex and it is crucial that every step is followed correctly as an incorrect step could result in the petition being dismissed by the courts. For this reason, seeking the assistance of a solicitor is strongly encouraged. Once the Winding-Up Petition has been filed with the courts, the courts will decide when and where the petition hearing will be heard before sealing the petition and returning copies of the papers to the petitioner’s solicitor to serve on to the debtor company at their registered office address. If the company is not available at this address, the papers can be served to a company director, secretary or the company’s last main place of business. At least seven days prior to the petition hearing date (and no sooner than 7 days after the petition has been served to the debtor company) the petition needs to be advertised in the London Gazette. Once a winding up petition has been filed, businesses tracking the financial information of the debtor company will start to be informed, likely resulting in the restriction of credit facilities and business bank accounts.

The Winding-Up Petition Hearing

On the day of the hearing, the courts may decide to;

Dismiss the petition – There are a few reasons as to why a petition may be dismissed such as; Full payment has been received, If it is believed that the petitioner has incorrectly issued the petition, if the company is able to pay a large amount of the debt owed, for instance if a CVA is proposed than the judge can leave the creditors to decide on whether to decline or accept.

Adjourn the hearing – The hearing is adjourned to be held at a later date, this may be due to the petitioning creditor receiving repayments and the debtor intends to make payment in full or the debtor may request more time to enter into a CVA.

Withdrawn – A Winding-Up petition can be withdrawn before the hearing by the petitioner. This will usually happen if payment has been received or a satisfactory agreement for repayment has been successfully negotiated with the creditor.

If a Winding-Up Order is made, an Official Receiver will be appointed and the company will enter into Compulsory Liquidation.

A winding-up order being “rescinded”

A winding-up order being “rescinded” refers to the reversal or cancellation of the order by the court. This typically occurs when new evidence or circumstances arise that warrant the reconsideration of the initial decision to wind up the company.

For example, if the company can demonstrate that it has settled its debts or has a viable plan to do so, the court may rescind the winding-up order. Alternatively, if there were procedural irregularities or errors in the original winding-up process, the court may rescind the order to rectify the situation.

Essentially, when a winding-up order is rescinded, it means that the decision to wind up the company is reversed, and the company is no longer subject to compulsory liquidation.

Supporting the Petition

Another creditor can choose to support the petition for a small fee, however again this is not without its risks. Should the petition fall down to the next supporter, this supporter is not guaranteed payment, even if the previous petitioner was paid in full. The supporter may also incur costs for the petition. The courts do not reveal who the supporters are, how much they are owed or how many supporters there are.

Risks of issuing a petition

Whilst Winding-Up Petitions can be very powerful, there are also risks for those issuing a Winding-Up Petition. Issuing a Winding-Up Petition may not result in payment. Unfortunately, if the company does not have any available funds or assets to sell in order to make payment, the company may enter into Compulsory Liquidation, resulting in the petitioner spending “good money after bad”. Additionally, if the petition becomes public knowledge, it may attract supporting creditors who are also owed and as a result the Directors may decide to enter into Voluntary Liquidation with the knowledge that they are not able to pay all supporters. A Winding-Up Petition does not make the petition a secured creditor. If the company enters into insolvency via either Voluntary Liquidation or Compulsory Liquidation, the petitioner may be considered an unsecured creditor and therefore any remaining assets will be shared equally among all unsecured creditors.

Creditor Payments whilst a petition is in place

If a creditor receives payment whilst a petition is in place, this may be viewed as preferential treatment of creditors if the company enters into Liquidation following the Winding-Up Petition hearing. The Insolvency Practitioner can order that these payments are returned in order to fairly distribute the remaining funds amongst unsecured creditors.